Headwinds in Wealth Management The Future of Financial Advice Depends on Organic Growth and a Paradigm Shift

May 2023

Straight To The Point

Profitability Lost

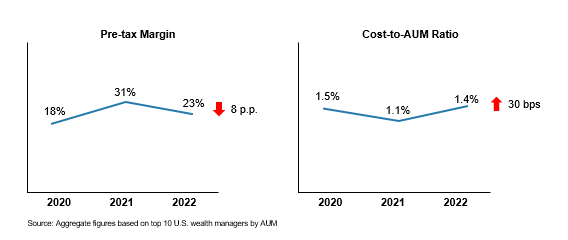

The last 18 months have seen some extraordinary changes in the business cycle and important implications for the future of wealth management. Contraction in business activity has contributed to slower growth, reduced earnings, and falling asset valuations based on higher costs of capital. The market has placed a drag on fee-based revenues and inflation continues to put upward pressure on operating expenses. Virtually all wealth managers saw their ratio of costs compared to assets under management (AUM) deteriorate.

Mixed Outcomes

Mixed Outcomes

As growth slowed, some sought to “buy” revenues by making acquisitions of firms and/or advisor teams but concerns persist about elevated less-than-fully normalized valuations which require repricing to reflect higher costs of capital. M&A may pick-up as we come out of the cycle but at present, much uncertainty remains on the timing and length of the contraction. Acquisitions did buy some revenues but it’s an expensive way to do so and scale by itself isn’t enough to achieve better profitability.

Recent efforts to drive growth also focused on product and experience innovation including increasing personalization, enhancing financial planning, and other like-minded enhancements. These investments didn't hurt but they moved firms further away from profitability and placed more service burden on the financial advisor. We see the resulting impact of this in the cost-per-AUM ratio increasing, indicating a reduced capacity to service the same number of clients and assets with existing resources. Wealth managers went backwards in a sense, lost marginal dollars of revenue, and squeezed margins.

Drifting Focus

Drifting Focus

Prior to and over the course of the pandemic, market performance was strong and advisors didn’t have to work that hard to see revenues grow. Today, with markets down and M&A slowing, most wealth managers are realizing the urgent need to reenergize their financial advisor teams and reengage with their clients, but to do so has never been easy. Organic growth and the role advisor teams play have always been critical to moving the needle on growth and profitability in wealth but growing like this takes a long time. Excitement and philosophy start strong, but over time the focus can drift, and leadership support can wane, either because the execution faltered, or results didn’t come fast enough.

Hard work is required from the leadership team to hold advisors accountable. A tight, integrated focus is required at the top level and a shared view of the strategy to be executed. Even then, organic growth efforts can fail if the change program isn’t mobilized and managed properly. Leaders can grow bored by this, and support can diminish if they don’t start to see results. Leaders must believe there will be a better result. Approaches have to be incredibly simple, or efforts can bog down and break under their own weight from complexity. The hearts and the souls of the leadership team must be bought-in and their level of engagement constant, as organic growth is hard work that never stops. A failure to focus on this now is truly an existential threat for any wealth manager, organic growth is an imperative for future survival.

Paradigm Shift

Paradigm Shift

True organic growth requires focus on the greatest potential sources of net new assets the firm has: its own clients and the advisors that earn their additional assets through their relationships and service. Advisors play a massive role in this context and are the most important leverage point for the firm. To do it right, organic growth requires the leadership team to create a vision and target blueprint for revamping and enhancing branded competencies and capabilities and to inspire advisors to expand wallet share and gather new clients. Doing it right means putting focus on the advisor practice model and processes supporting expanded advice, guidance and solutions. Wealth managers need to open-up the practice and pursue an advisor practice model that creates a branded client experience that is repeatable, differentiating, and durable.

The good news is that there is first mover advantage for those who would focus on optimizing the advisor practice management model. Not only in terms of ramping-up revenues but also to the benefit of addressing the current challenges around aging advisor workforces, client succession strategies, and leakage to the registered investment advisor model. The right kind of model will focus on building the most effective advisor teams possible.

A New Advisor Practice Model

A New Advisor Practice Model

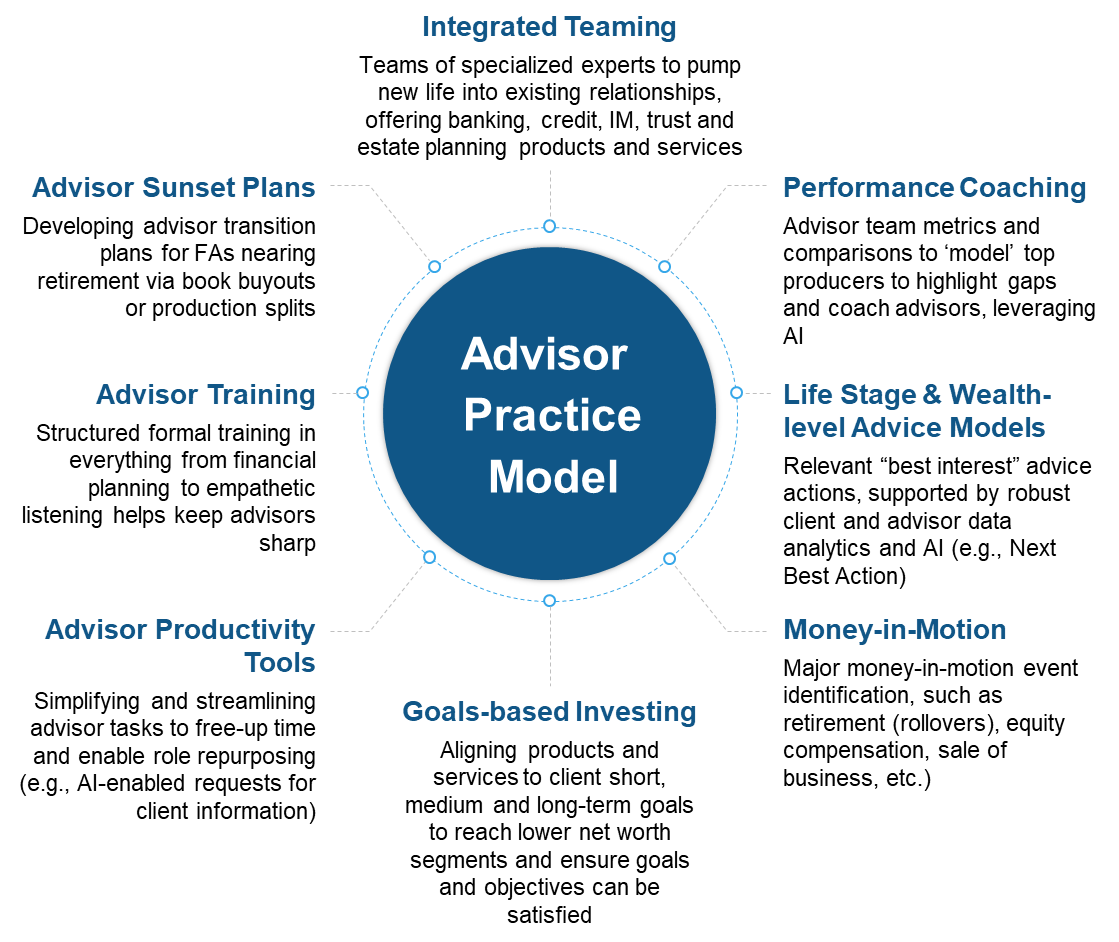

The goal to win in a fragmented industry is via the development of a preeminent set of capabilities to support advisor teams and their practice model in delivering a best-in-class experience that helps expand growth, margins, and shareholder value. The key is to focus on improving processes and the best place to start is at the point-of-sale and service with the advisor teams and their practice model. A new high-performing model combines eight synergistic elements to redefine what client engagement looks like.

When these components are working together, a firm will not only drive more revenue per advisor and client, but so too will increase their capacity to service greater numbers of clients and assets with existing resources; the key to unlocking profitable organic growth.

Where to Start

Where to Start

Achieving successful organic growth must begin with a crystal-clear shared view of the future practice model, a detailed blueprint, and a multi-generational road map for achieving set goals.

- Achieve a Shared Vision Amongst Leadership Team. Align views across the leadership team and key senior stakeholders to arrive at a shared vision of the future optimal practice model; how it will look, work, and be received by the clients when it is completed.

- Develop Detailed Blueprints of the Future Practice Model. Describe in detail the people, processes, technologies and data required to deliver the future practice model. Identify areas where ideas are beyond the current state of readiness.

- Develop the Multi-generational Road Map. Break-up the shared vision and gaps into smaller, manageable projects that can be completed in a relatively quickly. There are benefits to be accelerated by planning on implementing what you can now.

- Mobilize the Program While Continuing to Grow the Business. Continue to scale the business by focusing on the management of the advisors and teams and stay ahead of the curve.

How Reference Point Can Help

How Reference Point Can Help

Reference Point is solely focused on the financial services sector and offers its clients a different type of engagement model where we combine our expert network of senior industry executives with top-tier management consultants to achieve your solutions. This approach is particularly effective when looking to achieve a shared view amongst the leadership team for the optimal advisor practice model. Our unique approach can give you an unrivaled experience and a practically implementable future design informed by years of expertise and our range of services can support every element of your change journey and achieve an organic growth strategy and mobilized program that will achieve results. To learn more contact: Strategy@referencepoint.com

Meet the Team

Partner, Strategy, Wealth & Asset Management Leader

John Hogarty

Senior Advisor

Patrick Campion

Senior Advisor

Michael McPartland

Senior Advisor

Table of Contents

About Reference Point

Reference Point is a strategy, management, and technology consulting firm focused on delivering impactful solutions for the financial services industry. We combine proven experience and practical experience in a unique consulting model to give clients superior quality and superior value. Our engagements are led by former industry executives, supported by top-tier consultants. We partner with our clients to assess challenges and opportunities, create practical strategies, and implement new solutions to drive measurable value for them and their organizations.